Condo Insurance in and around St. Paul

Unlock great condo insurance in St. Paul

Cover your home, wisely

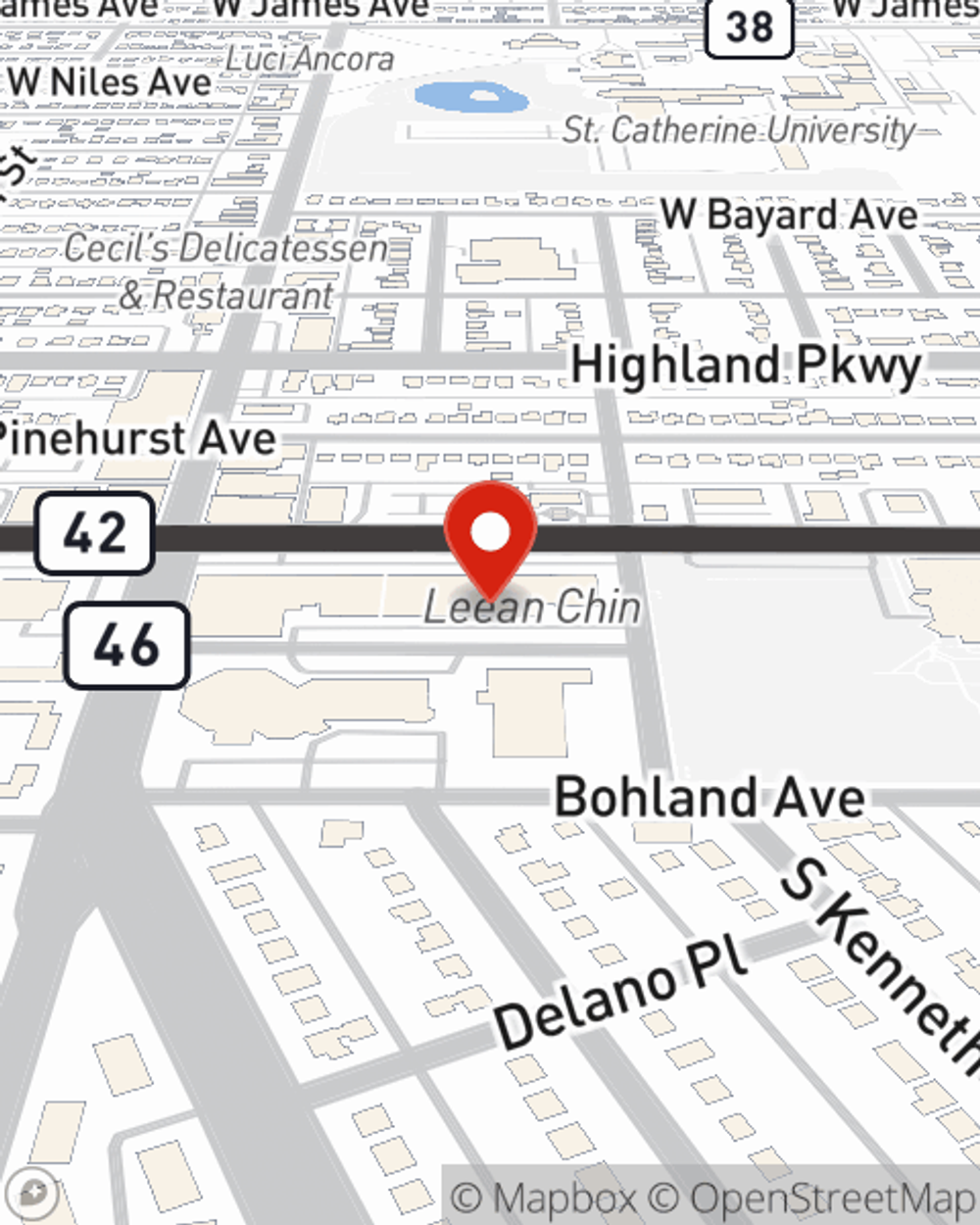

- Highland Park

- Eagan

- Saint Paul

- Rosemount

- Inver Grove Heights

- Burnsville

- Apple Valley

- Lakeville

- Farmington

- Northfield

- Savage

- Prior Lake

- Hastings

- New Market

- Bloomington

- West Saint Paul

- Mendota Heights

- Wisconsin

- Roseville

- Maplewood

- White Bear Lake

- Elko

- Coates

- Vermillion

Condo Sweet Condo Starts With State Farm

Often, your retreat is where you are most able to relax and enjoy your favorite people. That's one reason why your condo means so much to you.

Unlock great condo insurance in St. Paul

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

That’s why you need State Farm Condo Unitowners Insurance. Agent Leanne Casanova can roll out the welcome mat to help create a policy for your particular situation. You’ll feel right at home with Agent Leanne Casanova, with a hassle-free experience to get reliable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Leanne Casanova can help you file your claim whenever life goes wrong. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Leanne Casanova's office today to learn more about how you can save with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Leanne at (651) 454-7533 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Leanne Casanova

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.